Human Resources Information Systems (HRIS)

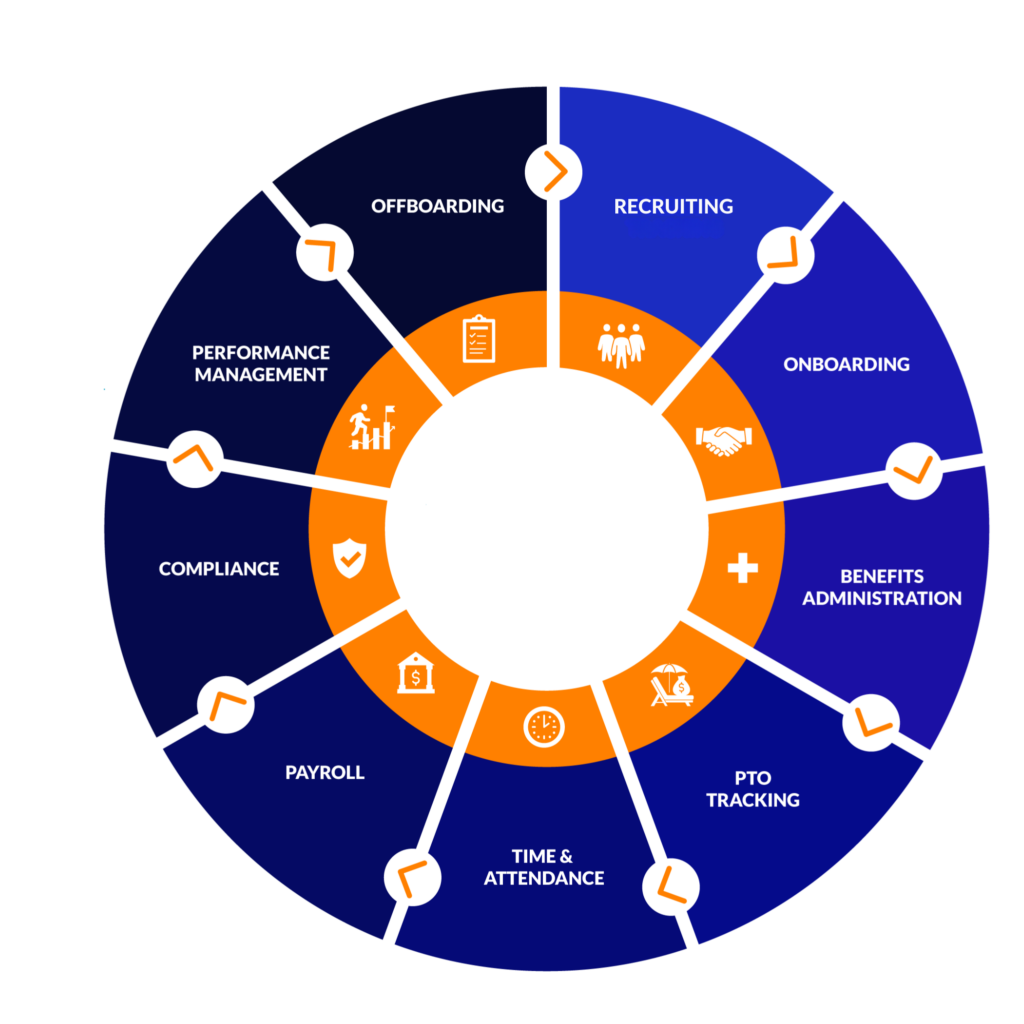

Everything you need to know about human resource information systems, including why you need an HRIS and what to look for when evaluating different platforms to move your HR administration online. Learn how an HRIS can help you streamline important HR tasks such as Applicant Tracking, Onboarding & Offboarding, Benefits Enrollment, PTO Tracking, Payroll, HR Compliance, and more.

What Is an HRIS?

What is an HRIS? A human resource information system also known as a human resource management system is a software that combines many different processes to ensure the ease of HR management. With the right HR software for small businesses, you can efficiently and effectively centralize, organize, and improve your day-to-day processes to help with human resource management and store employee information and other important HR data.

Most HRIS systems should comprise these components:

- Applicant Tracking System

- Onboarding

- Online Benefits Administration

- PTO Tracking

- Time & Attendance

- Payroll

- Compliance

- Performance Appraisals & Performance Management

- Form 1095-C Reporting

- COBRA Administration

Are all HRIS systems the same?

Not all HRIS platforms are created equally! Exceptional HRIS systems would also include billing options and robust reporting capabilities. Learn more about each of these components below.

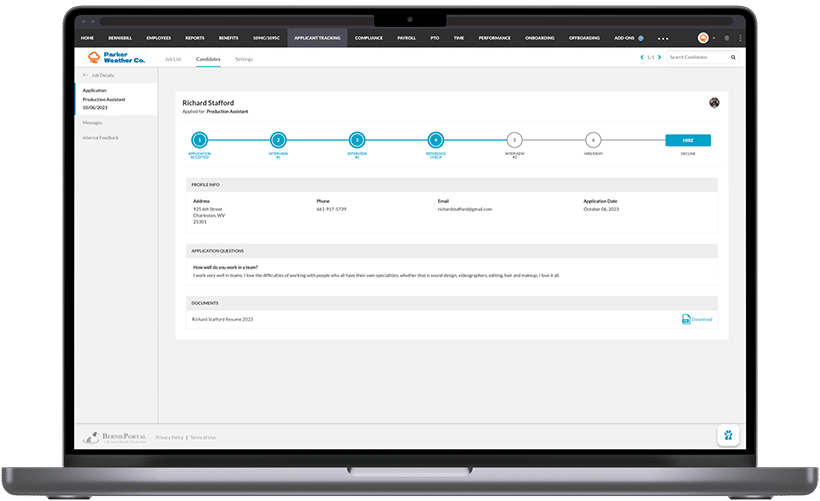

What Is an Applicant Tracking System (ATS)?

An applicant tracking system (ATS)—sometimes called applicant tracking software—is an HR software feature that streamlines the recruiting process. Typical applicant tracking systems allow you to post jobs, communicate with candidates, collaborate internally, extend job offers, and even onboard new hires.

These hiring systems can increase efficiencies within your recruitment process.

Benefits of an Applicant Tracking System

More and more, employers and HR leaders are using ATS platforms to optimize the recruitment process. For small- and mid-sized employers, these platforms help level the playing field, meaning organizations can better compete for top talent against big businesses—and HR leaders can make their jobs more valuable.

Some of the most notable ATS benefits include:

- Publish jobs across multiple job boards

- Quickly identify top candidates

- Automate routine hiring tasks

- Enhanced reporting and compliance

- Improved communication

- Paperwork elimination

- Simplified applicant experience

With this in mind, the best ATS platforms include the following features:

- No login required

- Integrations with job search tools

- Internal messaging

- Built-in functionality with HRIS

Learn more about BerniePortal’s Applicant Tracking feature!

What Is Onboarding Software?

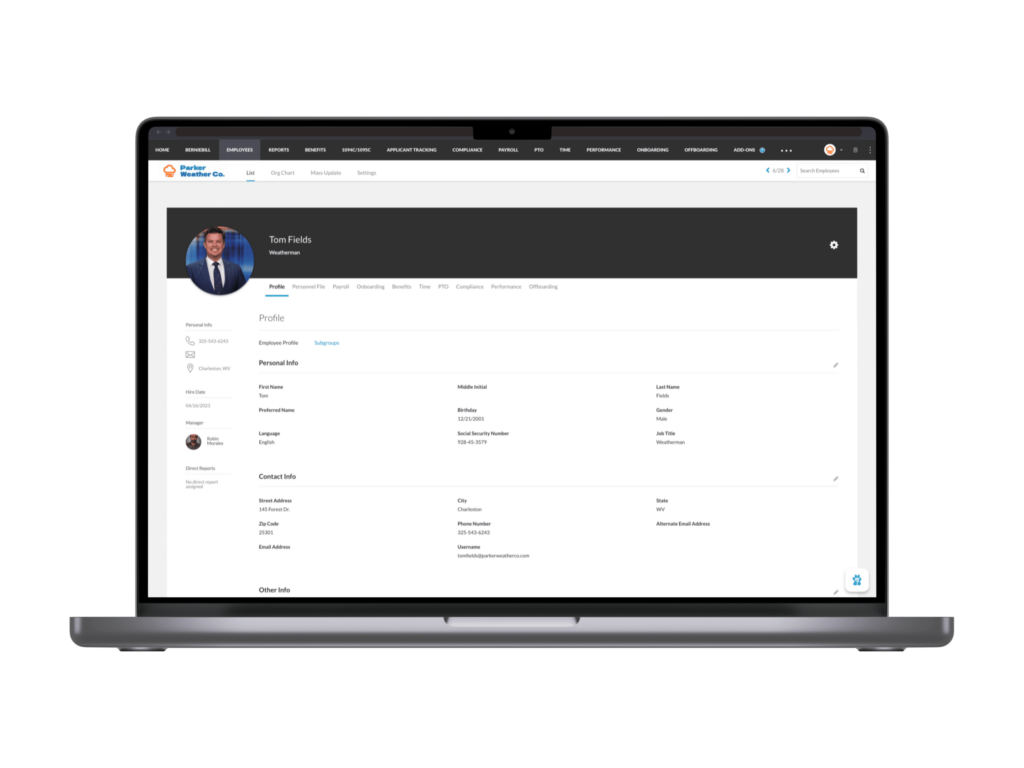

Onboarding refers to the action of integrating a new employee into an organization by providing the necessary knowledge, skills, and behaviors to be successful in the role.

Software that uses onboarding features makes this process simple and convenient. It provides new hires self-service access to important documents, benefits, and other materials before their first day. Using this software, employees should be able to complete federal forms such as Form W-4 and Form I-9, as well as other company-specific documents like company Culture Guides.

Benefits of Onboarding Software

The goal for onboarding software is to get your new hire fully up to speed and compliant so that their first day is dedicated to learning the business rather than filling out redundant documents.

Another significant consideration is onboarding can and does impact retention. The most effective onboarding processes are built with retention as an explicit end goal, meaning that employees can easily complete legal requirements, adopt the company’s technology, learn about the culture, and take care of other practical needs. HRIS platforms streamline this process for hiring managers and improve overall HR services.

When employees complete this process remotely, they can reach full productivity faster. Not only that, but digital onboarding reduces paperwork at the same time. With less time to full productivity for each of its employees, employers can more efficiently manage their organization’s bottom line.

Learn more about BerniePortal’s Onboarding feature!

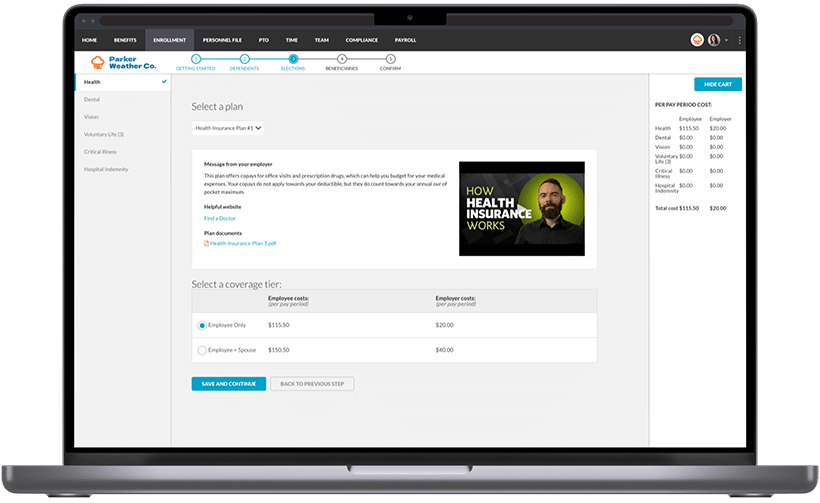

What Is an Online Benefits Administration Platform?

Benefits administration is the process of determining, designing, and managing employee benefits for an organization. Typically handled by HR, benefits administration consists of managing employee benefits such as health insurance, retirement plans, and paid time off packages.

A benefits administration platform is a software system that manages employer-sponsored benefits for employees—and, in some cases, can be managed by employees themselves. Not only do these systems streamline common HR administrative tasks, but they can automate eligibility for benefits, empower users to make benefits elections, and give users the opportunity to enroll in health insurance and ancillary options.

Benefits administration technology automates the traditional employee benefits selection and management process. Instead of filling out paperwork to select employer-sponsored benefits, employees can make selections using a digital system that automatically enrolls them in coverages once approved.

Benefits of an online benefits administration platform:

Benefits administration software offers several different benefits to organizations, employees, and HR. These include:

- Time Savings

- Reduce Errors

- Convenience and Satisfaction

- Benefits Analysis

- Enhanced Transparency

Benefits administration software can do more than streamline open enrollment. When paired with other HRIS functions, these platforms can make onboarding smoother—which can improve retention—help you recruit and hire the best candidates, and even shape your company culture in a more meaningful way.

Benefits are typically the most expensive line item in an organization’s budget next to payroll. Because of the investment in this part of the HR ecosystem, organizations should consider whether the system they utilize is robust enough in its benefits administration capabilities.

Typically, a system should be able to handle a full array of benefits, including life, critical illness, dental coverage, and more, as opposed to just the major medical plan.

Learn more about BerniePortal’s Benefits Administration feature!

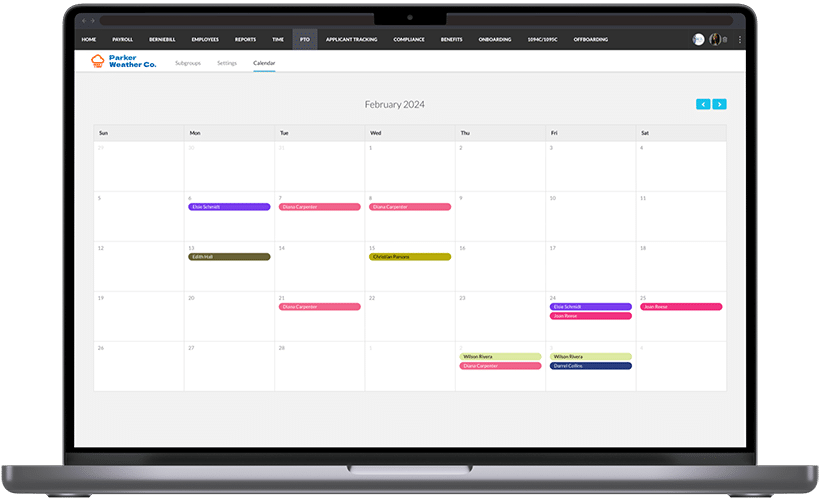

What Is PTO Tracking?

An HRIS system should include a paid time off (PTO) tracking feature that is accessible for both the employer and employee. Your PTO tracking system should permit the employee to request time off, track accrual balance, and monitor PTO usage.

Employees with a self-service PTO tracking platform can easily manage their time-off, which encourages PTO participation.

A quality tracking system will remove the need for spreadsheets, increase efficiency, reduce error, reduce staffing strain, and increase employee participation. Not to mention that it will save managers and HR hours of administrative time.

Why is PTO participation such a big deal? Unused vacation impacts your bottom line by creating financial liability, reducing productivity, and decreasing morale.

BerniePortal’s Payroll feature seamlessly populates employee PTO data, including customizable holiday hours, for every pay period. Admins can rest easy with more accurate paydays and less manual data entry.

Learn more about BerniePortal’s PTO Tracking feature!

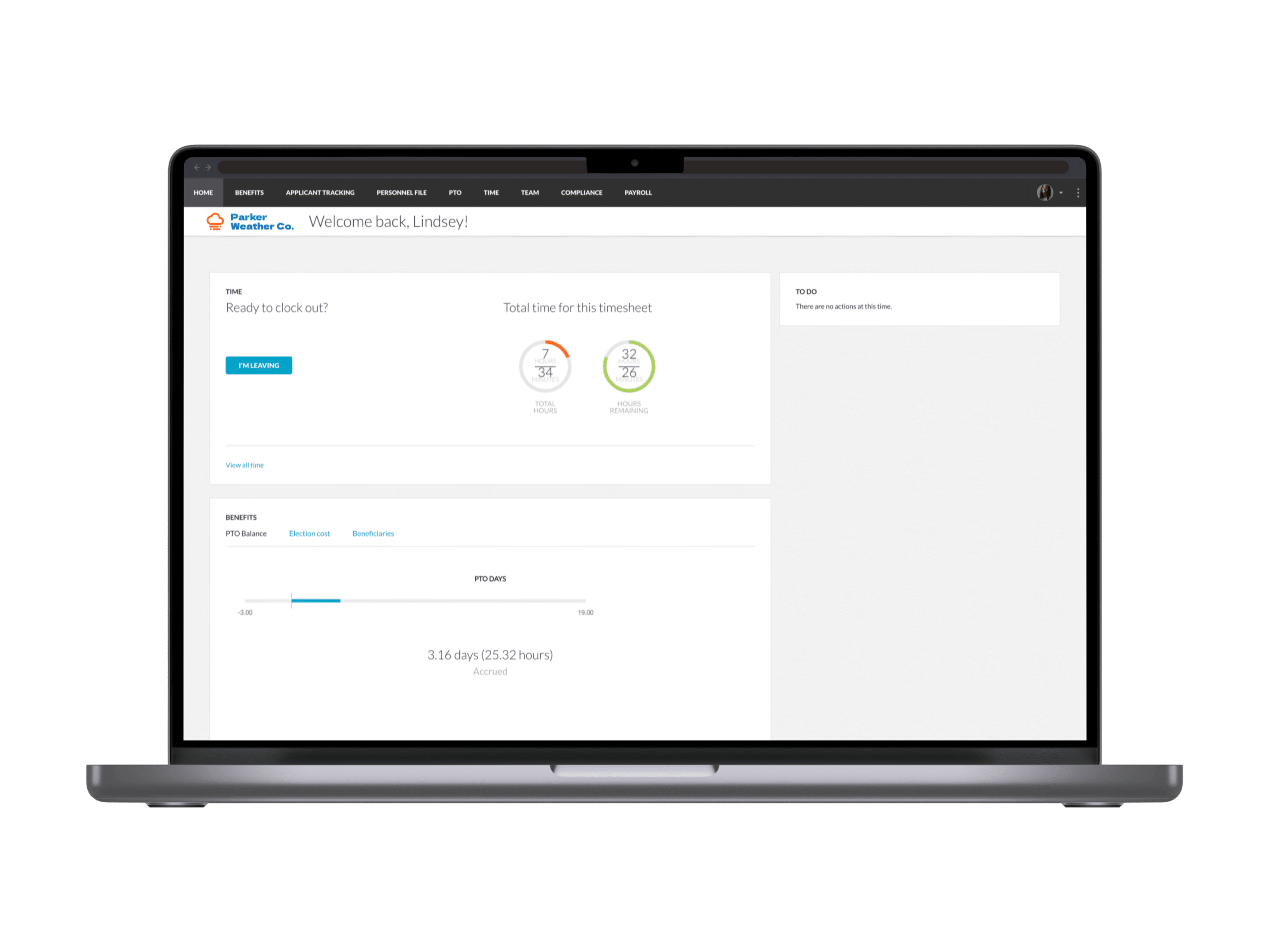

What Is Time & Attendance Software?

Time & attendance software is a simple, yet powerful human resources tool that allows administrators to precisely track employee hours without the paperwork. These systems should allow employees to clock in and out, request time edits, and review attendance history.

Benefits of time & attendance software:

Time & attendance software is especially valuable for organizations with a large number of hourly workers. Why? It allows managers to view and manage employee hours from an individual and holistic perspective.

With the right software in place, managers can better review trends, streamline inefficiencies, manage employee timesheets, and review cumulative staff hours. Not to mention that time and attendance software can help reduce time theft within your company.

Consider five features to look for in a time & attendance software system:

- Ability to clock in and out

- Editing functionality

- Location-based clock-in and clock-out

- At-a-glance in-and-out time board

- Payroll reporting

BerniePortal’s Payroll feature works in harmony with Time & Attendance by seamlessly auto-populating employee hours and overtime for every pay period. Save your organization money with accurate time calculations and less manual data entry using BerniePortal’s Payroll Feature.

Learn more about BerniePortal’s Time & Attendance feature!

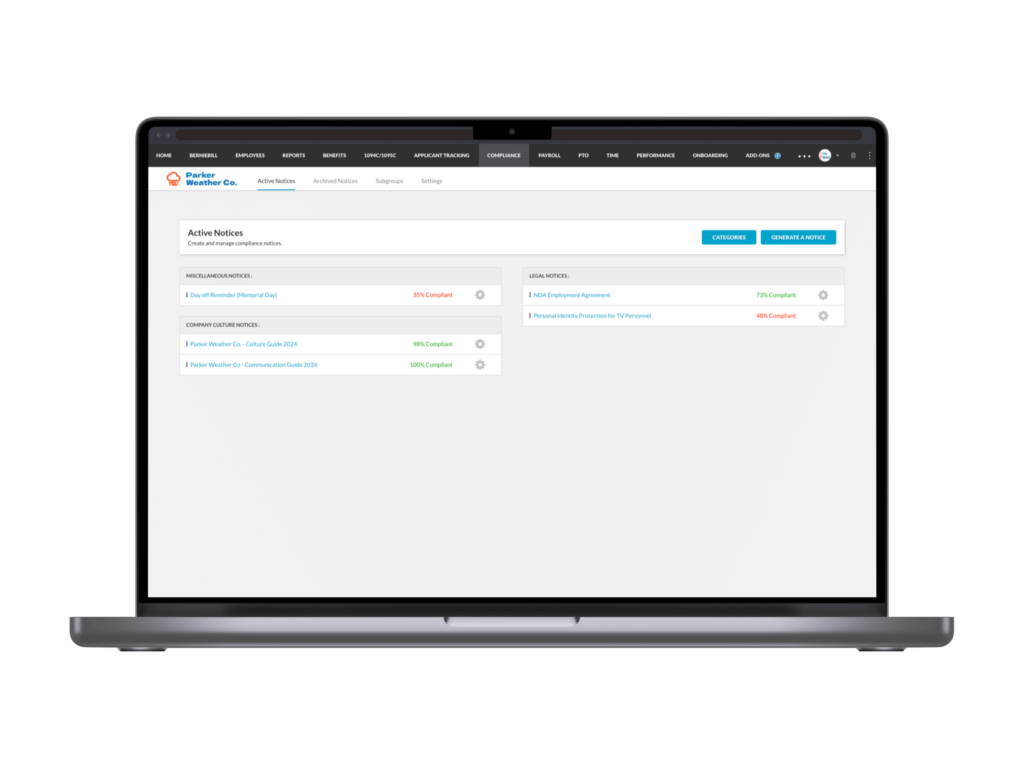

What is a Compliance Feature?

Your HRIS system should be an integral part of keeping your organization compliant. Find a system that allows you to manage your company’s adherence to key HR regulations and can increase the efficiency of your compliance practices.

Your platform’s compliance feature should manage employee handbooks/Culture Guides, distribute notices, collect signatures, and maintain year-round as well as real-time compliance documentation.

How Can a Compliance Feature Help Me?

Whether you like it or not, compliance is part of being a member of today’s workforce. A compliance feature helps HR keep up by centralizing all notices management. Rather than running around looking for a loose sheet of paper, HR can reference a single portal for all notices. By keeping everything in one spot, human resources personnel will also dedicate less time to administrative tasks.

Learn more about BerniePortal’s Compliance feature!

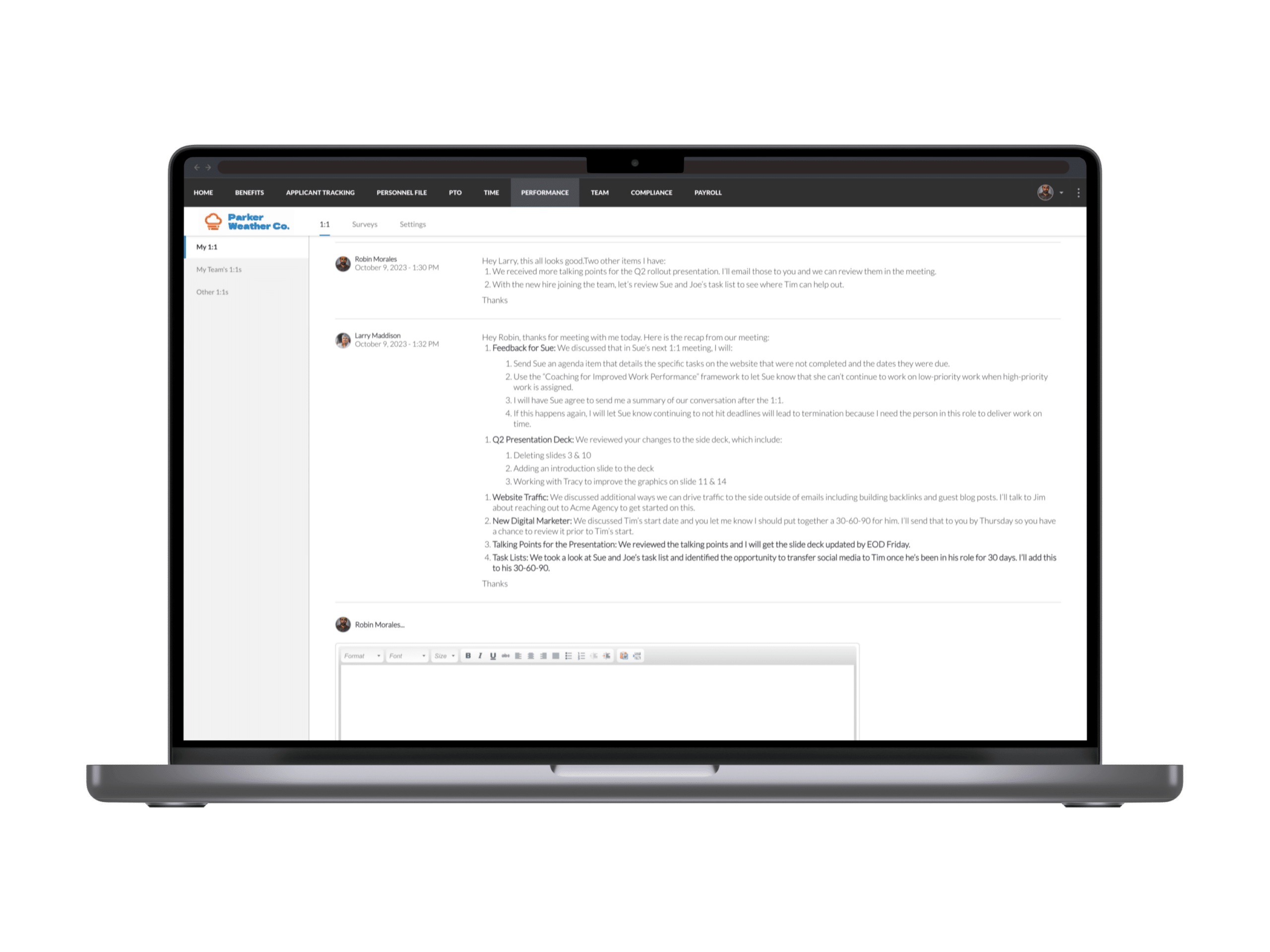

What Is Performance Management?

Performance management is an ongoing process of communication between a supervisor and an employee that occurs throughout the year. The purpose is to assess employee performance compared to company goals, as well as set additional goals for the upcoming year.

This process is often facilitated by 1:1 meetings.

What is a 1:1?

A 1:1 is a regular, typically weekly meeting that managers hold with each of their direct reports to provide an outlet for open communication and dialogue on the full scope of an employee’s responsibilities. During these meetings, participants discuss projects they’re working on, opportunities for improvement, ways in which employees are excelling, and how the teammate’s efforts contribute toward the company’s goals.

Continuous, concrete feedback is vital for employee improvement. It allows teammates to reflect on their project or task and follow through with improvements. Furthermore, managers of managers can identify how their direct reports are performing using 1:1 transcripts in the HRIS.

As a result, 1:1 meetings provide the opportunity for growth-centric conversations, as well as high-quality and regular feedback, both of which are important in promoting employee development, team member engagement, improving performance, and encouraging retention.

How can performance management help me?

Performance management helps maintain company-wide consistency and ensures compliance and accountability for managers and employees alike. Additionally, performance management software documents important conversations and events across an employee’s lifecycle, making sure all relevant parties can easily track performance and progress.

Surveys for Pulse

Positive company culture is critical in retention and often in recruiting top talent, too. BerniePortal makes it easy to take the pulse of employee and manager satisfaction with surveys. Company-wide surveys can help leadership teams meet organizational goals while individual surveys keep it personal by providing a platform for performance appraisal, reviews, 360-degree feedback, and goal setting.

Employees selected to participate in a survey will receive a real-time email notification when it goes live, alerting them to respond within their BerniePortal account. Use our performance management software to spend less time tracking down responses and more time putting employee feedback into action.

Learn more about BerniePortal’s Performance Management feature!

Form 1095-C Reporting

What is Form 1095-C?

The IRS requires Applicable Large Employers (ALE) to file Forms 1094-C and 1095-C as part of the Affordable Care Act (ACA). These forms report on the health insurance coverage offered by an employer.

One Form 1095-C must be generated and filed per employee while Form 1094-C acts as a cover page for all of the 1095-Cs. A Form 1095-C reporting solution compiles benefits data and generates these documents for you. Some HRIS providers even offer additional ACA services such as mailing filing and e-filing.

Download the “Am I an ALE? Calculator” to help determine if you qualify as an ALE:

How does Form 1095-C reporting benefit me?

Employers are faced with penalties if they don’t adhere to strict Forms 1094-C and 1095-C compliance regulations, which causes a lot of stress for HR professionals. This anxiety can be significantly reduced by automating the Form 1095-C reporting process.

Using a Form 1094-C/1095-C reporting solution, teams can eliminate duplicate data entry, reduce the risk of error, and decrease the amount of time spent on ACA compliance.

How do I know if I need to file Forms 1094-C and 1095-C?

In most cases, employers that meet the following criteria must file Forms 1094-C and 1095-C:

- 50+ Full-time employees

- 50+ Full-time employee equivalent: when the work time of 2+ employees adds up to a full-time employee workload

What is a full-time equivalent?

Full-time equivalency (FTE) represents an employee’s total hours worked divided by the number of compensable hours in a full-time schedule during a fiscal year.

For example, if an employer’s workweek is set at 50 hours—or, five 10-hour days—and an employee works all 50 hours each week, their FTE would be 1.0.

In general, the IRS classifies full-time and part-time employment status using the following hours per week:

- Full-time Employees: 30+ hours/week or 130+ hours/month

- Part-time Employees: under 30 hours/week

Example:

Roger and Amy are both part-time employees for a company with 49 full-time employees. Roger works 10 hours/week and Amy works 25 hours/week. Combined, Roger and Amy work 35 hours/week. Because the sum total of these employees is over 30 hours/week, the IRS counts them as 1 full-time employee. Now, the company has 50 “full-time” employees and qualifies as an ALE and therefore must file 1094-C and 1095-C forms.

ACA reporting & Form 1095-C:

To learn more about ACA reporting and how to fill out Form 1095-C, refer to this comprehensive resource.

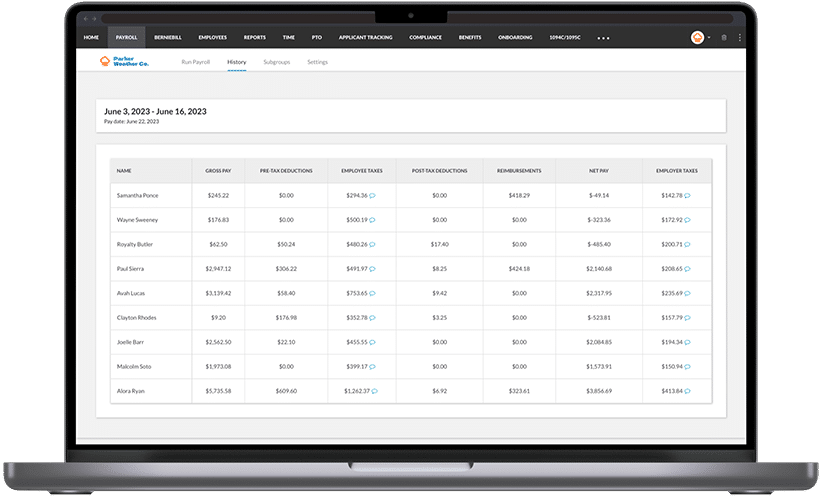

What Is a Payroll System?

Employees count on their paychecks to arrive on time and in the correct amount. This isn’t as simple as it seems. In an increasingly digital world, employers need a system that can help deliver accurate paychecks in time for payday.

A payroll system should be able to automate payroll and account for various factors such as total hours worked, benefit deductions, and even provide a record for tax compliance.

Why is payroll so important to an HRIS system?

Payroll accounts for a significant amount of an organization’s expenses. Incorrectly or inaccurate payroll systems can hurt both employees and a company’s bottom line.

Nearly two-thirds of Americans live paycheck to paycheck. An effective payroll system can reduce errors to get paychecks to employees when they need them most. And while many employees are underpaid due to payroll errors, others are actually being overpaid at their employer’s expense. It almost goes without saying, but companies that constantly or consistently overpay employees are also constantly and consistently hurting their own bottom line.

Learn more about BerniePortal’s Payroll feature!

What Is COBRA Administration?

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a set of laws put into place by the Department of Labor (DOL) to protect employees from the possibility of losing health insurance coverage. Under COBRA, group health plan administrators must offer a continuation of group health insurance coverage to qualified beneficiaries for a limited period of time and up to 102% of the cost of the healthcare premium.

COBRA administration and compliance add yet another layer of difficulty to successful administration. This complexity often leads to strict penalties for noncompliance. An HRIS that offers COBRA administrative services can ease these stressors.

Learn more about BerniePortal’s COBRA Administrative Service through Alpine!

What Is a Reporting System?

A quality HRIS will host quite a bit of information. But users don’t need all of this information at once—more likely in bits and pieces. This is where a reporting system comes in handy. An HRIS platform should allow employers to export specific pieces of data as needed. These reporting options should be robust, yet easy to understand.

What Are the Most Useful Reports for New Users?

Benefits Deductions: Some HRIS systems like BerniePortal offer payroll integration options, but that’s not always the case in other systems. With so many people relying on employers to run payroll promptly and accurately, it’s essential to have a benefits deduction reporting tool readily available. Using this tool, organizations can export all data necessary to take care of payroll—meaning employees have the money they need to pay the bills and put food on the table.

Notices: A compliant business is responsible for distributing an array of notices to its employees. These notices often require employee acknowledgment of the notice via signature. Of course, without documentation, employers can’t prove they collected employee signatures. An HRIS system should include a reporting option that allows administrators to export all signed notices so that when audits come around, the business is 100% compliant. Not only will this reporting option keep employers compliant, but it will also save the time and stress associated with manually compiling information.

Turnover: It’s no secret that the recruiting market is in the hands of candidates. More and more frequently, employees leave their current positions in order to seek alternative opportunities. Naturally, when a position is vacated, it must be filled—which can be costly. A quality turnover reporting tool will allow users to monitor and assess turnover trends within your organization. By understanding these trends, administrators will have greater insight into the business and, as a result, have the opportunity to manage turnover costs.

What Is Carrier Billing?

Believe it or not, incorrect carrier bills happen all the time. A billing solution built into an HRIS platform allows carriers to issue bills directly through the benefits platform using the most up-to-date benefits data.

Why do I need to have a billing solution to get accurate carrier bills?

Inaccurate billing occurs when carrier databases don’t have access to up-to-date benefits enrollment and eligibility records. When carrier databases don’t have this access, they can’t account for changes such as adds and terms when they distribute bills. It’s often difficult for carriers to collect this real-time data because an integration needs to take place.

What Factors Should Be Considered When Selecting an HRIS?

As HR software platforms grow more common in U.S. workplaces, automation is helping rethink how the HR department operates. Now, human resources roles are becoming less about managing administrative tasks and more about adding strategic value to organizations.

This is good news—technology is giving HR the room to focus more on people and skills.

Yet not all HRIS platforms offer the same benefits. Consider the following key factors when making an HRIS purchase decision.

What are the Advantages of an HRIS?

When employers find the right HRIS platform, the role of HR becomes more strategic—and more valuable. HRIS software …

Improves efficiencies:

By reducing the administrative burden of chasing the paperwork, the HR department can focus on higher-skill tasks that contribute to business growth and employee experience—including improving recruiting and coaching.

Ensure compliance:

Easily send required notices and other employee communication, and track employees’ receipt and signing to ensure compliance.

Reduce errors:

Ensure accuracy and resolve errors or inconsistencies in real-time.

Cut the paperwork:

From onboarding to benefits enrollment and more, many HR departments are drowning in paperwork. An HRIS eliminates the need for paper records by storing HR information and data online. Doing so is often safer, more secure, and much, much more streamlined.

Boost recruitment and retention:

From the initial onboarding experience and throughout the employee life-cycle, make it easy for employees to manage their benefits and information online.

What to Look for in an HRIS

Employee self-service (ESS):

ESS systems are online workplace tools that provide employees with unique logins that allow employees to view and edit personal information. Traditionally, only HR could make these transactional changes because records were kept on paperwork. With online EES options available, HR staff can grant employees permission to enter and edit personal information as needed.

If employees have the proper tools, they can solve small, day-to-day problems without any administrative assistance. Because the employees are solving problems themselves, HR pros have time to complete more specialized tasks.

Single point of data entry:

When filing paperwork, how many times do you enter an individual employee’s name? It can add up, particularly if HR is stuck inputting benefits info, onboarding details, reporting, attendance, applicant tracking, payroll, and PTO.

HRIS systems remember specific pieces of data and automatically populate all fields using that same piece of data.

Example:

Jane the administrator just hired Sally using BerniePortal HRIS. When Sally applied, she entered her name into BerniePortal’s applicant tracking system. Because the name ‘Sally’ was already entered once, it will never have to be entered again by Jane or Sally for any of the HRIS functions.

Centralized data:

Throw out the filing cabinet. Quality HR software organizes employee data for users, which empowers administrators to collect more data without spending extra time sifting through information. In other words, HR can keep everything in one accessible location without having to sift through a mountain of paperwork.

Comprehensive tools:

Reporting: Human resources professionals must continually manage important pieces of information for large amounts of people. This requires keen attention to detail, significant time investment, and the execution of redundant tasks. That’s why reporting options are essential for every organization. Reporting eliminates many transactional administrative tasks which allow HR professionals to focus on specialized responsibilities.

Dashboard: Because HR covers so much professional territory, looking at an organization from a holistic perspective can be quite daunting. Great HR software platforms provide a dashboard tool that allows users to visualize organizational trends and without losing the human element that is so important in human resources.

User Experience (UX):

UX is a technical term that stands for “user experience,” which describes a user’s interaction with a given software. User experience is determined by different factors such as design, structure, and simplicity—each of which should serve to address the unique needs of a software’s users.

User experience is integral in evaluating different HR software options because it determines the usability of the software. A quality HR system should be able to simplify the appearance of essential software functions so that the user feels comfortable with a powerful system.

Documentation:

It’s hard to tell in advance what will come in handy later on, so when it comes to documentation, more is better. An HRIS should clearly and concisely document important HR information and employee data.

Dedicated support:

When deciding on an HRIS, it is imperative to understand each vendor’s support model and how it factors into the pricing of the platform. Some vendors offer competitive prices but require upgrades for service after the purchase. Others include service in the overall pricing, but establish a maximum amount of service.

The best support option provides full support and build-outs for no additional cost. HR should look for a software provider that offers full-service implementation to get the most bang for their buck.

The nature of the support offered is just as important. Some companies offer call-center support, which can be a difficult and time-consuming method of service. Users should find a vendor that provides them with a dedicated representative and a partnership approach.

Support systems should be structured so that the success of the service team member is dependent upon the success of the client.

Native solutions:

Native software is software that is created, managed, and sold by the same company. Essentially, all activities associated with native software occur “in-house.” Because native software is developed internally, the vendor of that native software can respond more quickly to client concerns and requests. Furthermore, a native software vendor will have a greater understanding of their platform.

Alternatively, some software vendors earn rights to license software built by another company. While this strategy provides consumers with a wider selection of products, it also limits the vendor’s ability to address software bugs and glitches. This is because vendors that sell non-native software do not have the same level of understanding of the system as those who developed it.

Similarly, these vendors also do not have access to the developer side of the business and therefore cannot prioritize specific client needs. If users have a client pressuring them to fix a system error, their hands are basically tied.

HRIS Myths

A common misconception is that HR software takes value away from the administrator. However, the result is quite the opposite. HR software streamlines transactional challenges which, in turn, allows administrators to focus on more specialized tasks that require strategic HR expertise—making the administrator’s role more strategic and more valuable.

How to Adopt HR Technology

Understanding the Market

Small and mid-sized employers have a few different options for bringing their HR needs online with software. Understanding the market will allow business leaders to find the right solution provider for them.

Generally, a key differentiator among these systems is their go-to-market approach. Some systems market directly to employers, while others provide their software to employers through value-added resellers, such as a benefits broker.

While many platforms used to take extreme positions on either side of that spectrum, the various players are now recognizing that when it comes to serving the needs of small and mid-sized employers and their brokers, it is unwise to separate the two parties completely.

Because benefits touch so many parts of the HR ecosystem—from onboarding to payroll to time tracking and more—it is better to serve the needs of both sides through a system that fully integrates benefits and benefits brokers into HR administration. Further, because the compliance stakes are so high for small and mid-sized employers, administering HR with the support of an advisor typically produces the best long-term outcomes.

How to Implement an HRIS System

1. Identify options:

Employers should ask their benefits broker if they provide any kind of benefits and HR solution. If they already provide an online enrollment system, employers should ask whether it has additional HR functionality. It’s also recommended that employers solicit suggestions from other businesses or business advisors.

2. Request and attend demos:

Employers should contact the recommended vendors to schedule demonstrations of their products.

Request to see a demo of BerniePortal’s HR Software today:

3. Adopt the system:

HR should prepare to learn how to use the system effectively and coach other team members based on how they will interact with the system. Likewise, it’s recommended that HR adds this information to the company Culture Guide to ensure that instructions and tutorials are easily available to all employees.

What’s Next?

More employers are taking advantage of software solutions to streamline HR, improve efficiencies, and reduce errors. But how does an organization know which type of HR solution is the best fit?

Take the course below for information on how to adopt HR technology, solutions to compare, and where and how to find the best HR software solution.

Ready to Go Online with BerniePortal?

See all the benefits and capabilities of BerniePortal’s all-in-one benefits administration & HR software.