Form 1094-C / Form 1095-C Reporting

In this guide, we will cover the basics of Form 1094-C and Form 1095-C, what employers need to know, and the technology solutions available to ease the burden of these reporting requirements. You will also learn how to calculate your organization’s ALE status, how to maintain form-filing compliance with the IRS, and how to choose the best HRIS to streamline 1094-C and 1095-C reporting.

The Affordable Care Act (ACA) requires employers with 50 or more full-time equivalent employees—known as Applicable Large Employers (ALE)—to offer healthcare coverage to full-time employees or potentially face a fine. The IRS uses Forms 1094-C and 1095-C to keep track of this information from one year to the next.

In addition, the form helps the IRS determine which employees were eligible for subsidies for individual health insurance during the year. Employees who were offered qualified insured coverage by their employers are not eligible for these subsidies in the months they were offered qualified coverage.

How to Calculate ALE Status

Applicable Large Employers (ALE) must file and distribute Form 1094-C and Form 1095-C each year. Employers are encouraged to use a calculator to determine their ALE status or use the following steps:

1. Calculate the number of full-time employees (FTE) per month.

Add all the FTEs for each month together to get a subtotal.

2. Calculate the number of hours worked by non-FTEs per month.

Divide this number by 120 to determine the number of full-time equivalents. Add all months together to get a subtotal.

3. Add the two subtotals together.

4. Divide the total by 12.

5. If the total is less than 50, you are NOT an ALE. If the total is greater than 50, you ARE an ALE.

What is Form 1095-C?

Beginning in the 2015 tax year, employers with more than 50 full-time employees (or full-time equivalents) are required to report certain health insurance information to the IRS.

Known as Form 1095-C, this document helps the IRS determine whether the employer owes a penalty for not offering qualifying coverage. Note: A 1095-C must be filed for every person employed that year, not just current employees.

What Are the Different Sections of Form 1095-C?

1095-C Part I: Employee and ALE Information

Where basic employer and employee information is reported, including Social Security Number, name, address, and the federal employer identification number (FEIN).

1095-C Part II: Employee Offer and Coverage

This is the section where employers detail the coverage, cost, and the reason for offering it or not.

1095-C Part III: Covered Individuals

This section is where employers report details about anyone who is covered under a self-insured plan.

Important Form 1095-C Requirements

With the introduction of the ACA and new reporting requirements, ALEs are required to provide a statement annually to each full-time employee that details the employer’s health coverage offer—or, in some cases, lack of offer.

Self-funded or self-insured employers that provide minimum essential coverage (MEC) are also required to provide an annual statement to employees and former employees who are covered. These annual statements are recorded on Form 1095-C.

For employers to consistently describe their health coverage offers to employees, the IRS created different sets of codes to be entered into lines 14, 15, 16, and 17 on Form 1095-C. To find full descriptions for each of these codes, they can be found on page 2 of the most recent version of the form.

For Line 14, applicable codes should be used to address:

- Whether an individual was offered coverage

- The type of coverage that was offered

- Which months the coverage was offered

For Line 15:

Employers report the employee required contribution, or the monthly cost to an employee for the lowest-cost, self-only minimum essential coverage (providing minimum value) that the employer offered. In general, when reporting for individual coverage IRAs—or, ICHRAs—the listed contribution should be the ICHRA amount divided by 12.

For Line 16, applicable codes should be used to address:

- If the individual was employed part-time or full-time

- If the employee was enrolled in coverage

- If the coverage was affordable, and if so, which IRS safe harbor was used to determine affordability

- If the employer is eligible for transition relief as a contributor to a union health plan or as an employer with a non-calendar year plan

For Line 17:

Employers should report the applicable ZIP Code they used for determining affordability if an employee was offered an ICHRA.

What is Form 1094-C?

The 1094-C can be thought of as a cover sheet for all of an organization’s 1095-Cs. It isn’t distributed to employees and requires information such as the number of people employed and how many 1095-C forms are being filed.

Employers need to know that they must file one Form 1094-C per tax ID (or EIN) to the IRS. This means that even if your company oversees different divisions or employment groups, separate Forms 1094-C must be filed if these groups have individual EIN.

What Sections of Form 1094-C Do Employers Have to Fill Out?

1094-C Part I: Applicable Large Employer Member (ALE Member)

This section is where employers add details about your business, including address, name, and your FEIN.

1094-C Part II: ALE Member Information

In Part II, employers summarize the number of 1095-Cs you’re filing.

1094-C Part III: ALE Member Information—Monthly

This is where employers denote if they provided minimum essential coverage (MEC) each month.

1094-C Part IV: Other ALE Member of Aggregated ALE Group

Employers can skip this section if they’re a member of a group of aggregated companies.

Staying Compliant with IRS Requirements

To stay compliant with the IRS, ALEs must:

✔ Provide minimum essential coverage to all full-time employees.

✔ File one Form 1094-C to the IRS—Employers with more than one Employer Identification Number (EIN) must file one Form 1094-C for every EIN.

✔ File one Form 1095-C to the IRS for every full-time employee employed any month of the calendar year.

✔ Distribute one individualized Form 1095-C to every full-time employee.

How to Distribute Form 1095-C to Employees

Acceptable distribution channels

- Hand delivery

- Email (if prior consent given)

- Distribute to employees using BerniePortal services

Save time and stay compliant by distributing Form 1095-C to employees using BerniePortal’s mailing services!

File With the IRS

Once Forms 1094-C and 1095-C have been generated and reviewed, employers then need to file these forms with the IRS either electronically or by mail. With this in mind, Employers that plan to file more than 250 Form 1095-C documents are required to submit data to the IRS electronically.

IRS filing deadlines for the 2022 tax year

Following recently announced regulation changes, the IRS has set the deadline for furnishing form 1095-C to employees, on March 2, 2023, marking a permanent 30-day extension. The deadline for filing forms with the IRS is February 28, 2023, for those who choose to file paper copies, and March 31, 2023, for those choosing to file electronically. Look below for a breakdown:

- Mailing: File to IRS by Feb. 28, 2023

- E-Filing: File to IRS by March 31, 2023

- Furnish to Employees: Distribute by March 2, 2023

Tips for filing Forms 1094-C and 1095-C by mail

Employers with fewer than 250 employees can file Forms 1094-Cs and 1095-C by mail. Review the following IRS guidelines before filing:

✔ Do not fold forms (use flat mailing)

✔ Do not paper clip or staple the forms together

✔ If you are sending many forms, use conveniently-size packages

Note: If using convenient-sized packages, write your name, number the packages consecutively, and place Form 1094-C in package number one.

What address should I use when filing Forms 1094-C and 1095-C with the IRS?

If your principal business, office/agency, or legal residence (in the case of an individual) is located in:

Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, or West Virginia…

Mailing Address to IRS:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301

If your principal business, office/agency, or legal residence (in the case of an individual) is located in:

Alaska, California, Colorado, District of Columbia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming…

Mailing Address to IRS:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

How to e-file Form 1094-C and Form 1095-C

Employers have two options when submitting digital files: Either become accredited to electronically submit to the IRS by obtaining a Transmitter Control Code (TCC) or working with an accredited vendor.

Ideally, an employer’s broker will offer an HRIS that has a benefits administration feature to ensure all relevant data is in one place. For example, BerniePortal uses a Transmitter Control Code that enables users to electronically file forms directly with the IRS. This technology removes the administrative burden of Form 1095-C reporting—saving employers time and reducing errors.

Fines Associated with Form 1094-C and 1095-C Compliance Failures

For reporting in 2022, employers that fail to comply with Form 1094-C and 1095-C reporting requirements may be subject to fines, including:

- Failing to file carries a $560 fine per tax return

- Failing to file electronically when required to do so carries a $280 fine per tax return

Choosing a Form 1095-C Vendor

The HR software industry continues to grow. Now, employers can use digital tools to solve compliance concerns, calculate and distribute payroll, and even administer benefits during open enrollment. By adopting a human resources information system (HRIS), organizations can streamline these human resources tasks, which saves time and permits HR to operate more strategically. This includes compiling and submitting ACA forms.

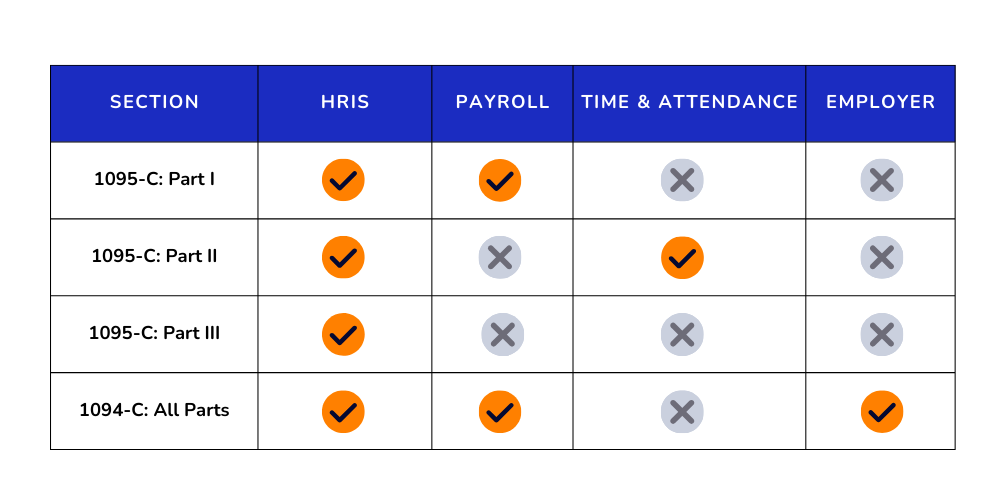

But, not all solutions are created equal. Consider the following technology solutions that can be used to file ACA documents:

Option 1: Payroll Companies

Payroll companies are familiar with filing tax forms, which leads many employers to believe that payroll is equipped to handle Form 1094-C and 1095-C reporting. Form 1095-C, however, requires benefits information—which isn’t collected by payroll providers. This means that employers must collect benefits data and submit it to the payroll provider. This collection and transfer of data is an unnecessary extra step.

Option 2: Standalone Vendors

Standalone vendors are solutions that exclusively provide Form 1095-C solutions. Because standalone vendor Form 1095-C solutions act independent of other systems, they must pull information from different sources—meaning they run a much higher risk of error. The same is true of payroll companies as the information must be outsourced.

Option 3: HRIS Vendors

HRIS software providers are the most logical platforms to use when filing Forms 1094-C and 1095-C. Why? HRIS software already hosts all information necessary to complete both Form 1094-C and Form 1095-C.

BerniePortal Form 1094-C and 1095-C Reporting

All employers using BerniePortal have access to Form 1094-C and 1095-C Reporting for no additional cost. This feature compiles key benefits information and uses that information to populate your 1094-Cs and 1095-Cs.

In addition to the reporting feature, BerniePortal also offers mailing and filing services for tax records. The result? Employers and HR teams can spend less time worrying about compliance and more time adding strategic value to their organizations.

Learn More About Forms 1094-C and 1095-C

Updated for 2022, Intro to Forms 1094-C and 1095-C is a free continuing education course that teaches registrants everything they need to know about these essential ACA documents. From what they are and how they work to updates for the new year and common employee FAQs, participants who finish this BernieU course will be more prepared than ever to take on reporting in 2022.

Ready to Go Online with BerniePortal?

See how BerniePortal’s 1094-C / 1095-C Reporting can streamline ACA compliance.