HR’s Guide to Payroll Basics

This quick and comprehensive guide includes everything human resources professionals need to know about payroll—including how to decide which payroll schedule is best for your company, setting up automatic payments for employees, and whether to outsource payroll or manage it in house. Check out the payroll glossary at the end.

HR pros know payroll is complicated. If everything goes perfectly, no one notices—but if you make one error, the consequences can be costly.

Why is payroll so complicated in the first place? Have you ever wondered why you can’t just cut employees a check every two weeks? From the history behind payroll to how to select the right pay schedule for your team, here are all the payroll basics that HR needs to know.

Introduction to Payroll for Small Businesses

What is Payroll?

Payroll is the way in which employers compensate employees. From compliance to payment schedules to direct deposits, payroll is composed of various components that ensure workers receive their correct wages and that federal, state, and local governments receive their tax revenue.

How Does Employee Compensation Work?

Employee compensation is an employee’s regular salary or hourly pay as well as overtime, bonuses, retirement benefits, health benefits, stock options, and other non-financial incentives.

In most cases, an employee’s compensation is reflected on their paycheck, which includes both gross pay and net pay. The former indicates the wages the worker earned during the corresponding pay period before taxes are withheld and benefits are deducted; the latter is the sum of the employee’s wages after these withholdings and deductions—sometimes called “take-home pay”.

When an employee joins an organization, they fill out Form W-4, which indicates how much federal income tax employers should withhold from their wages. Other state and local taxes are taken from the individual’s gross pay as well.

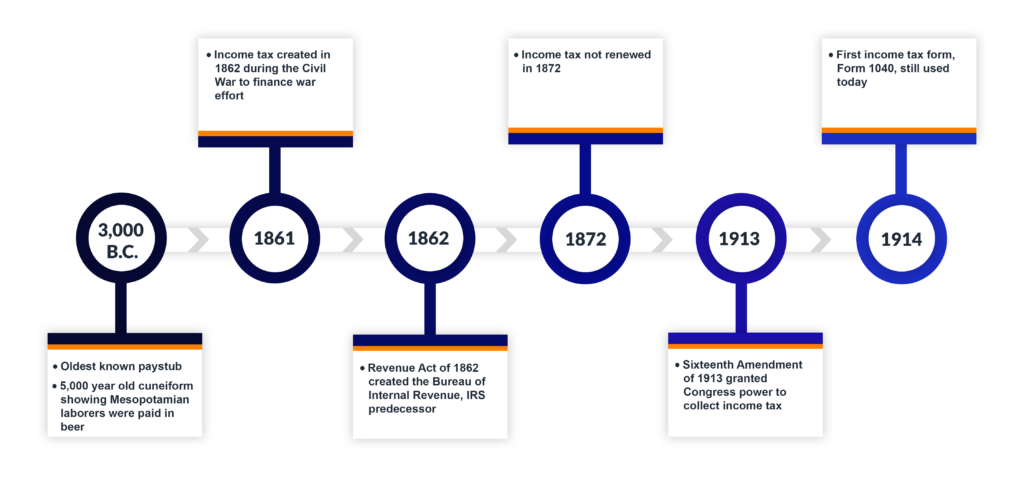

A Quick History of Employer Withholding

Employers can’t simply write checks to employees because of employer income tax withholding.

What is Employer Withholding?

Employers must withhold, deposit, and report employment taxes. These include federal income tax, Social Security, and Medicare taxes.

The first U.S. income tax was implemented in 1861 during the Civil War to finance the war effort. It wasn’t renewed after the war, but there was renewed support for income tax during the early 20th century.

The Sixteenth Amendment of 1913 granted Congress the power to collect income tax. In 1914, the first income tax form—Form 1040—was created and is still used today.

How Did Employers Become Responsible for Withholding Taxes?

Even after the Sixteenth Amendment was ratified, few people owed any income tax payments until 1940, but tax obligations increased to finance World War II. To more efficiently collect those taxes, the Treasury Department implemented employer withholding in 1943.

Pay Schedules

Pay schedules refer to both pay periods and pay dates. The pay period refers to the time frame employees worked, and the pay date is when they receive their wages earned within that time frame.

What is a Typical Payroll Cycle?

Employers have options when it comes to how often to pay employees. The most common payroll schedule options include monthly, semimonthly, biweekly, and weekly.

Semimonthly is twice per month while a biweekly approach delivers paychecks every other week. Biweekly pay schedules have two additional pay periods per year than semimonthly pay schedules.

State laws determine the minimum pay period—in other words, the minimum frequency you can pay. Click here to see a list of state regulations.

Monthly

12 Pay Periods

Semi-monthly

24 Pay Periods

Bi-weekly

26 Pay Periods

Weekly

52 Pay Periods

Picking a Pay Schedule

Why Payroll is Important

Every organization needs to determine which payroll schedule is right for its company. Doing so can impact company culture, employee satisfaction, and even recruitment and retention rates. If you only paid your employees once per year, for example, how many teammates could you realistically hire or keep on staff? Not many.

But selecting the right pay schedule is much easier said than done. Small to midsize employers must take into account the needs of the organization and the needs of their employees before making their decision.

Additionally, consider the following four factors that may impact your decision:

Payroll Compliance and State Laws

State laws require a minimum pay period or the minimum frequency that organizations must pay, and this varies from state to state. The most common minimum pay period allowed is semimonthly, while many states like California, Connecticut, Iowa, and more have a required weekly minimum pay period.

Processing Costs

Each time you run payroll, a cost is incurred, which means that organizations should accommodate for these costs when selecting a pay schedule and payroll system. In other words, more frequent pay periods could cost your organization more per year.

Accounting Implications (Overtime)

Federal law states that overtime pay rates need to be calculated every week. If you have a semimonthly pay schedule, you still need to consider the overtime implications of hourly employees when running payroll.

Benefits Deductions

HR should consider how benefits deductions will be calculated per pay period. For example, if an organization deducts health insurance benefits once per month for the premium payment, both the employer and employee need to know when that deduction will be made.

How to Decide Which Payroll Schedule to Select

Factors that Impact Payroll Schedule Selection

When weighing options between payroll schedules, it’s important to take into account the kinds of employees you have, and the cost, time, and resources you need to manage your payroll.

For example, an organization that employs a lot of independent contractors may decide a monthly schedule works best for its team. On the other hand, organizations that have a limited HR or payroll team may decide to take the biweekly route. Ultimately, however, it’s up to each individual organization to make this decision based on its unique makeup.

How to Change Payroll Schedules

If you determine your organization needs to adjust your payment schedule, you should:

- Analyze the current pay schedule to see if any pay periods line up and choose the best point in time to adopt the new schedule.

- Reevaluate near the end of the fiscal year or end of the quarter.

- Communicate the change to employees—especially if you intend to decrease the frequency of pay, as it will impact their budgets.

How Do I Pay My Employees Automatically?

In many industries around the country, employers elect to offer direct deposit compensation options to employees. With this approach, wages are deposited directly into each teammate’s bank account on the appropriate payday.

What Are the Benefits of Direct Deposit Payroll Systems?

Direct deposit payroll systems provide a number of benefits to employees and employers alike. They include:

- Convenience: No more physical paper to keep up with.

- Access: Employees have immediate access to their wages on payday, even if they aren’t in the office that day.

- Cost Savings: It costs money to print out paychecks! Direct deposit eliminates this biweekly or semimonthly expense.

- Immediacy: Employers don’t need to wait for employees to cash checks to account for reductions in payroll budgets every week.

- Security: Employees no longer lose paystubs, which can put the organization at risk if important bank information gets into the wrong hands.

What Do You Need to Do to Set Up Direct Deposit?

Employers and HR teams should work with their trusted banking institution to set up direct deposit functions for their payroll accounts.

Once established, employers can provide direct deposit forms to employees during onboarding or anytime the employee changes their personal banking institution. Teammates then complete these forms by filling out their account information and delivering them to human resources.

Then, HR furnishes these forms to the organization’s banking institution.

Running Payroll In-House vs. Outsourcing

Do Payroll Yourself

This is the lowest-cost option, but it’s time-consuming and error-prone. HR and accounting teams will need to use a spreadsheet and will need to calculate taxes.

Payroll Service

Payroll services are more costly, but it’s generally more reliable with fewer errors.

Hire an Accountant to Manage Payroll

This is the most expensive, but often most reliable option.

What Do Payroll Providers Do?

1. Payroll Processing

Payroll providers automatically calculate how much employees should be paid.

2. Filing and Paying Payroll Taxes

These services can handle withholdings, quarterly reports, and issuing employee Form W-2 and Form 1099.

3. New Hire Reporting to the Government

This is key to remaining in compliance.

4. HR and Benefits Administration Integrations

Payroll providers can ensure employee benefits deductions and time tracking implications on payroll are accounted for.

5. Payroll Reporting

HR can receive detailed reports on payroll data.

BerniePortal’s Payroll Solution

BerniePortal is an all-in-one HRIS that provides solutions for the full scope of small to midsize businesses’ HR needs, including payroll management through BerniePortal Payroll.

With BerniePortal Payroll employers will not only be able to manage and process detailed employee information, but they will also have the ability to implement all aspects of the payroll process, making BerniePortal a robust and attractive HRIS platform.

Here’s a breakdown of BerniePortal Payroll’s main features:

Seamless Integration, All-in-One HR

BerniePortal Payroll blends intuitively with all other BerniePortal award-winning HRIS software features to streamline every aspect of the employee lifecycle, from tracking employee hours to benefits and PTO.

Elimination of Third-Party Payroll Providers

BerniePortal Payroll automatically populates employee data, including hours worked, PTO, and benefit deductions to prepare scheduled payroll runs. By eliminating the manual data entry component for each payroll run, BerniePortal Payroll not only saves precious time, but it also improves payroll accuracy. Plus, having payroll as part of the BerniePortal HRIS package is simply convenient.

Accurate Tax Withholding

With BerniePortal Payroll, there’s no need to worry about compliance with federal regulations since it automatically calculates what each employee is required to pay, no matter where in the US your employees are located.

Unlimited Number of Payroll Runs

For those occasions when you need to schedule pay runs that fall outside of the regular pay schedule, HR can feel satisfied knowing that BerniePortal Payroll will allow them to conduct as many payroll runs as necessary–and with no extra cost!

Access to a Dedicated Support Team

Organizations can feel confident knowing that when questions arise, BerniePortal Payroll’s support team is staffed with experienced payroll experts who are eager to provide top-of-the-line support whenever help is needed.

Access to a Robust Library of Resources

As an integral part of BerniePortal, BerniePortal Payroll users can find an abundance of resources to help them navigate payroll–or anything HR-related for that matter. This comprehensive library is updated regularly with new and relevant content:

- BernieU–offers free, online HR courses that are approved for SHRM and HRCI recertification credit

- HR Party of One–the popular YouTube series and podcast covering emerging HR trends and enduring HR topics

- Knowledge Base–BerniePortal’s extensive help forum

- BerniePortal Blog–if it’s HR-related, it’s there!

Affordable Prices

BerniePortal Payroll offers attractive pricing that won’t break the bank.

BerniePortal Payroll is so much more than simply a payroll provider; it’s part of an all-inclusive experience that begins with applicant tracking and follows the candidate through their entire HR lifecycle.

Learn more about how BerniePortal Payroll can work for your organization, schedule a demo here or visit www.BerniePortal.com.

Payroll Glossary

Mastering payroll means comprehending a laundry list of terms. Review some of the most commonly used payroll terms and definitions you need to know:

401(k):

A 401(k) is a retirement plan that’s sponsored by employers allowing employees to save and invest a portion of their paycheck pre-tax.

Adjusted Gross Income:

An employee’s gross income minus specific deductions.

Allowances/Exemptions:

These are marked on an employee’s Form W-4 and reduces their taxable income. They are based on statuses or circumstances, like marriage or children.

Annual Wage:

The total amount an employee will be paid in wages during a calendar year.

Commission:

A commission is a fee paid to an employee for performing a service or selling a product.

Compliance:

Compliance is the process of fulfilling official requirements. Payroll managers should perform extensive research to educate themselves on all relevant laws or outsource the responsibility to an accountant, payroll provider, or professional organization.

Dependent:

A dependent is an individual that a taxpayer claims an exemption—for example, children.

Earned Income Tax Credit (EITC):

The earned income tax credit (EITC) is a tax credit for certain people who’ve earned income under a threshold defined by the IRS. Households can use the agency’s EITC assistant to calculate if they qualify to receive the credit.

Employer Identification Number (EIN):

What is an EIN? Also known as the Federal Identification Number, the EIN is a unique, nine-digit number issued by the IRS to identify every organization for tax purposes.

Fair Labor Standards Act (FLSA):

The FLSA is a federal law that sets the rules for minimum wage, overtime pay, record-keeping, and child labor. The law applies to both private and public businesses so it is important to familiarize yourself with the standards and understand how to properly classify and pay employees.

Federal Insurance Contributions Act (FICA):

The Federal Insurance Contributions Act (FICA)—a federal payroll tax—requires employers to withhold three separate taxes from the wages that are paid to employees. FICA is comprised of the following taxes: a 6.2% Social Security tax, a 1.45% Medicare tax (the “regular” Medicare tax), and a 0.9% Medicare surtax when the employee earns over $200,000.

Federal Withholding Rates:

A federal income tax rate based on a person’s taxable income and filing/marital status.

Form 941:

Form 941 is also known as the Employer’s Quarterly Federal Tax Return. It tells the IRS how much income tax, Social Security tax, and Medicare tax an employer has withheld from its employees’ paychecks during the previous quarter. Download a blank 941 form here.

Form 1099:

A year-end summary of all non-employee compensation that includes money you paid to independent contractors, freelancers, vendors, landlords—in other words, anyone not on staff. Download a blank 1099 form here.

Form W-2:

Form W-2 is a report of how much compensation an employer paid to an employee for the previous year and how much in taxes were withheld. These forms are divided into state and federal sections since employees file taxes with each. Download a blank W-2 form here.

Form W-4:

Form W-4 is completed by employees and indicates to employers how much money the employee wants to withhold from their paycheck for taxes. The form should be filled out on the employee’s first day and it includes information such as marital status, number of dependents, exemptions claimed, and more. Download a blank W-4 form here.

Form W-9:

A form that employers use to gather basic identity and tax information from independent contractors. Although employers don’t withhold taxes for independent contractors, they are required to tell the IRS how much they paid them over the course of one year if the amount exceeds $600. Employers use the information in the W-9 to report the income to the IRS. Download a blank Form W-9 here.

Fringe Benefits:

Fringe benefits are a form of compensation provided by the employer other than income, such as company cars, health insurance, or employee discounts. Such benefits are subject to federal and state taxes and must be reported to the IRS on an employee’s W-2.

Federal Unemployment Tax Act (FUTA):

A piece of legislation that authorized the federal government to collect taxes from employers for the purpose of funding state unemployment agencies and compensating former employees who are eligible for unemployment insurance.

Garnishments:

Deductions that must be withheld from an employee’s wages to satisfy the person’s debts or legal obligations. Common garnishments include child support, unpaid taxes, or defaulted student loans.

Gross Pay:

Gross pay is the total amount of a person’s salary before taxes or other deductions are subtracted.

Income Tax:

Taxes all individuals or entities must pay that varies with their taxable income.

Independent Contractor:

An independent contractor is a worker hired for a specific and limited scope of work. They should determine the manner in which they complete their tasks. There are several key differences between employees and independent contractors that employers must consider when conducting payroll and taxes.

Medicare Tax:

Part of the FICA, the Medicare Tax funds Medicare hospital insurance for certain Americans.

Minimum Wage:

Minimum wage is the lowest wage permitted by law (from a federal or state level) that a worker can be paid. Currently, the federal minimum wage for covered nonexempt employees is $7.25 per hour—this has not changed since 2009. Many states have their own minimum wage rates. Review the state minimum wage laws provided by the U.S. Department of Labor to learn more.

Net Pay:

Net pay is the amount an employee makes after all tax and benefits deductions are taken from their paycheck.

What’s the difference between net pay vs. gross pay? In general, net pay is how much a person “takes home” after all taxes and payroll deductions have been factored into their gross pay wages.

Overtime Pay:

Unless an employee is exempt, the FLSA requires those covered to receive overtime pay for over 40 hours in a workweek. According to the DOL, the rate should not be less than time-and-a-half of the regular rate of pay. Non-exempt employees who work over 40 hours in a week must be given this pay, which is equal to at least time and a half of their regular rate.

Pay Period:

The number of days for which an employee is paid, for example, weekly, bi-weekly, semi-monthly, or monthly.

Social Security:

Part of FICA, Social Security helps fund benefits for retirees.

Supplemental Pay:

In general, supplemental pay includes all wages that are paid to employees outside of their typical compensation. Supplemental pay can include commission (if not already factored into the employee’s compensation), overtime, annual or quarterly bonuses, and more.

Take-Home Pay:

The amount of pay a worker takes home from each paycheck after all deductions and withholdings have been taken out.

Withholding Tax:

A government requirement for all taxpayers that come from an employee’s pay.

Wages:

A fixed regular payment made by an employer to an employee for a job or task.

Ready to Go Online with BerniePortal?

See all the benefits and capabilities of BerniePortal’s all-in-one benefits administration & HR software.