How to Streamline Benefits Enrollment

The ultimate introduction to group health insurance enrollment, including what it is, how to handle it, and how to reduce stress by streamlining benefits enrollment and administration. This guide covers important tips for open enrollment success, frequently asked questions you may have while setting up your benefits administration software, and how your company should handle the post-enrollment period.

What is Open Enrollment?

Because open enrollment restricts the time frame during which people can sign up for health insurance, HR administrators and their brokers handle a lot of questions and policy changes all at once.

Traditionally, open enrollment is inefficient. First, there are endless forms for employees to fill out. Then the employer has to scan or fax the forms to their broker for review. Whoops, there’s an error, so it’s back to the employee for corrections.

Then to payroll to find the right amount to be deducted from an employee’s paycheck. Finally, you alert the carriers through a variety of platforms—mail, faxes, email, web forms—depending on the company.

But of course, that isn’t the end. Next comes the record maintenance. Each and every time there’s a change, you’re back in the middle of the paperwork.

The result of all this inefficiency is frustration. But, there is a better way. Below are actionable tips and strategies to ensure a successful open enrollment season.

How Long Does Open Enrollment Last?

Annual open enrollment elections take place once per year while special enrollment periods can occur whenever a qualifying life event occurs. Most employers conduct annual open enrollment two to four weeks before the effective date of new benefits. However, the actual timeframe is set by employers and differs from one to the next.

With this in mind, the open enrollment period for ACA-compliant healthcare coverage is administered by one of the following formats:

- Federal-Facilitated Marketplace (FFM): People living in these states purchase health insurance through the Department of Health and Human Services (HHS).

- State-Based Marketplace (SBM): States facilitate all marketplace functions, including setting open enrollment periods.

- State-Based Marketplace-Federal Platform (SBM-FP): States facilitate all marketplace functions except for eligibility and enrollment, which is administered by HHS.

The marketplace elections period typically begins in November and concludes in mid-December, though some states offer more flexibility with extended deadlines. Full details can be found at healthcare.gov.

Medicare Advantage Plans (Part C) and Medicare prescription drug coverage (Part D) also operate on an open enrollment model. There are two separate enrollment periods, both of which can be found at medicare.gov.

What Qualifies as a Special Enrollment Period?

Special enrollment periods (SEP) take place when an individual or family experiences a qualifying life event. These changes to the person’s circumstances allow them to make adjustments to their benefits no matter the time of year.

According to the Federal government, there are four primary types of qualifying events:

- Loss of health coverage: This can include job-based and individual coverage, as well as student health plans. Typically these events occur when a person is laid off, fired, their company/organization shuts down operations, or the person leaves college. Other instances include losing eligibility for Medicare, Medicaid, or CHIP, and when a person loses coverage through a parent’s plan after turning 26.

- Changes in household: Examples include getting married or divorced, having a baby or adopting a child, and a death in the family.

- Changes in residence: Examples include when someone moves to a different ZIP code or county, when a student moves to or from the place where they attend school, a seasonal worker moving to or from the place they both live and work, and someone moving to or from a shelter or other transitional housing.

- Other qualifying events: Other types of events can include changes in a person’s income that impact the coverage they qualify for, gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA), becoming a U.S. citizen, leaving incarceration, and when AmeriCorps members begin or end their service.

Open Enrollment Terminology

Here are the most commonly used open enrollment terms and definitions you need to know!

Benefit Provider

The company providing insurance coverage.

COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a set of laws put into place by the Department of Labor (DOL) in order to protect employees from the possibility of losing health insurance coverage. Under COBRA, employers with a group health plan and 20 or more full-time employees must offer a continuation of group health insurance coverage to qualified beneficiaries for a limited period of time.

Copayment

A fixed amount that an individual pays at the time of service each time you visit a doctor or fill a prescription. Your copayment amount is printed on your Health Insurance ID card. Copays are used to cover a portion of the cost of a doctor’s visit or medication.

Coinsurance

Coinsurance refers to your share of costs of a covered health care service after your deductible has been met. It serves as a way of indicating that you and your insurance each pay a share of eligible costs that add up to 100%. While some plans pay for the entirety of medical costs in these instances, others don’t cover the whole amount.

Deductible

The amount you pay each year for most eligible medical services or medications before your health insurance begins to contribute to the cost of covered services.

Dependent

An individual for whom a parent, relative, or other person provides healthcare. In turn, they claim a personal exemption tax deduction. A dependent is typically a child under age 26.

Effective Date

Effective date is the date an insurance policy goes into effect and coverage under that plan begins.

Evidence of Insurability (EOI)

Also known as a statement of good health. Benefits are available to all employees with proof of health status. Evidence of insurability (EOI) will only apply to some benefits, such as disability, and life plans.

Flexible Spending Account (FSA)

A flexible spending account (FSA) is an employer-owned account that helps employees pay for medical expenses. Although there is a maximum amount that can be contributed annually, both the employer and employee may make deposits into this type of account.

Guaranteed Issue

Coverage that is available to all employees without evidence of insurability (proof of good health).

Health Maintenance Organization (HMO)

A healthcare plan that provides people with all in-network care, therefore employees or individuals covered by an HMO have one primary care physician for appointments and are not permitted to receive covered care out-of-network.

Health Reimbursement Arrangement (HRA)

A Health Reimbursement Arrangement (HRA), sometimes called a Health Reimbursement Account, is an employer-funded (and owned) group health plan. Through HRAs, employees receive tax-free reimbursement for qualified medical expenses up to a certain dollar amount per year. Additionally, unused funds may roll over year to year.

Health Savings Account (HSA)

A personal bank account with significant tax advantages that can be used by an individual to pay for medical expenses, typically on high-deductible health insurance plans. A wide variety of banking institutions around the country offer health savings accounts (HSAs) to single users and families.

Monthly Premium

The amount you pay per month for coverage in a health plan. If you have employer coverage, your employer may pay all, some, or none of your premium.

Network

A health insurance network is comprised of the facilities, providers, and suppliers an individual’s health insurer or plan has contracted with to provide healthcare services, either through the private healthcare exchange or through an employer-sponsored plan.

Open Enrollment

The time an employer’s employee benefits renew and employees are able to change their coverages. Most employers hold open enrollment 2-4 weeks before the effective date.

Out-of-Pocket Maximum

This is the most an employee could pay for covered medical expenses each year. The amount includes money they spend on deductibles, copays, and coinsurance. Once a person has reached their annual out-of-pocket maximum, their health insurance will pay for covered medical and prescription costs for the rest of the year.

Preferred Provider Organization (PPO)

A preferred provider organization (PPO) offers users the freedom to choose where they receive care and from whom, both in and out of their network. Additionally, these plans do not require a primary care physician (PCP) to be chosen prior to enrollment.

Waiting Period

How long an employee must work for a company before their benefits become effective. Waiting periods are set by the employer.

Qualifying Event

A life event that allows a person to make changes to their benefits mid-year including marriage, divorce, adopting or having a child, and losing other coverage.

The Pros of Enrolling Online

Benefits administration and enrollment can be complex, confusing, and extremely time-consuming for agencies, employers, and employees. And to make the process even more challenging, many groups still enroll on paper.

Shifting benefits administration online dramatically simplifies and streamlines the process. Here’s how:

The Pros

Save Time

Employers with paper benefits administration spend hours per enrollee completing even the simplest tasks. The strain of manual administrative responsibilities like entering employee information, distributing and collecting multiple forms, and preparing benefits packets haunts HR administrators every year during open enrollment.

An online platform collects, stores, and maps data so that you don’t have to. The takeaway? Time savings—and likely less frustration—for everyone.

Reduce Error

Shifting benefits administration online significantly reduces the risk of error inherent in manual data entry. Between indiscernible handwriting, blank fields, typos, and incorrect information, there is so much room for error.

These hundreds of tiny mistakes add up to not-so-tiny dollars and hours of reconciliation. But, there is a solution: Find a best-in-class HRIS that automates the data collection process and integrates with carriers, which drastically reduces the opportunity for error.

Expand Benefit Offerings

Processing enrollment manually is such an arduous task that employers are often resistant to offer a wider variety of plans for fear of the manpower needed to do so. Additionally, many employers are concerned they won’t be able to keep track of numerous plans and ancillary options, not to mention the likelihood of more confusion for employees trying to understand the nuanced differences between each plan in a 50-page benefits booklet.

An online benefits administration system organizes, manages, and communicates plan details in an easily digestible and digital format. From customized messages to helpful videos and links, all the information employees need to compare plans is available during the process in one central hub, making it much easier to offer additional coverage options without adding confusion for employees or more work for employers and HR administrators.

Increase Satisfaction

According to a report conducted by Harris Poll, 41% of employees feel as though the open enrollment process at their company is “extremely confusing” and 49% say making health insurance decisions is always “very stressful” for them. Ensure employees have a more positive open enrollment experience and are more engaged in selecting their benefits with online enrollment.

Bringing the process online often delivers more clarity about benefits. Additionally, employers, employees, and brokers all have access to benefit information and real-time resources, which in turn increases understanding and satisfaction for all parties involved—and drastically reduces the number of questions your agency is tasked with answering.

4 Tips to Ensure Online Open Enrollment Success

Open enrollment is often difficult, time-consuming, and stressful. For many employers, benefits are the costliest expense outside of payroll. With this in mind, consider four ways you can approach open enrollment this season—and other best practices to help you finish the process strong.

Get Organized Early

Be proactive and prepare well in advance. There is no such thing as starting too early. HR should review the previous year’s open enrollment process to determine which materials, tactics, and communications worked most effectively—and which might need to be revamped.

Make Deadlines and Meet Them

It’s imperative that teams develop a detailed plan or timeline with clearly defined goals and objectives for their employees. Avoid pushing these deadlines to stay on track throughout the process, but also don’t rush deadlines if unnecessary—doing so could add stress and pressure for everyone on the team. Trust the timeline and deadlines you created.

Maintain Clear Communication

No matter how much HR teams plan, they’re always confronted with something unexpected. When faced with an emergency that forces you to move a deadline or reassign a project, make sure to communicate changes to everyone involved, whether it’s your brokerage or your employees.

Create Efficiencies in the Process

If you haven’t already, move your company’s open enrollment online. A benefits administration platform cuts down on HR’s administrative burden—making the entire process more efficient and streamlined. Period.

Benefits Administration Software

With an online benefits administration platform, HR can cut the paperwork, reduce errors, and make it easy to maintain and update records—meaning less time in perpetual support mode.

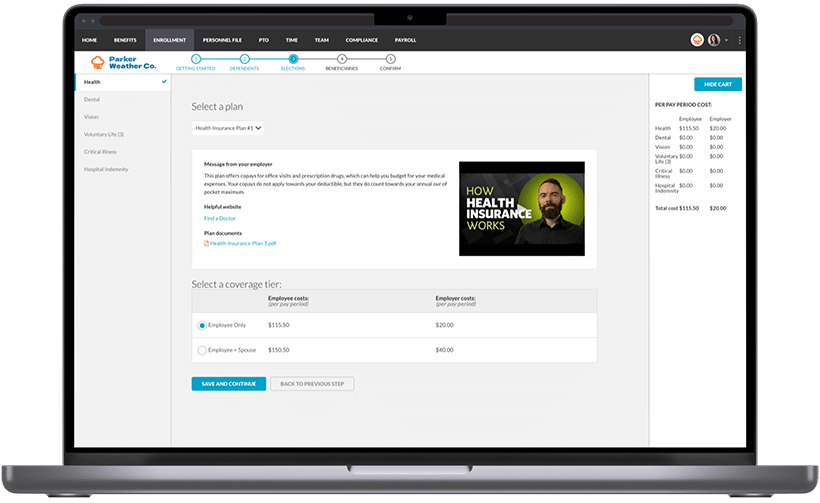

Instead of paper forms and benefit guidebooks, everything’s online. Employees can review the Explanation of Benefits, as well as any documents you provide to illustrate new offerings or changes in their benefits.

Employees easily make their elections through the portal. The shopping cart function makes it simple to understand what each plan option costs, as well as what the employer is paying and what employees’ payroll deduction will be.

BerniePortal is industry-leading in its integration capabilities, which makes communicating employee elections to carriers easier than ever. The option you use will be based on carrier availability.

After open enrollment, BerniePortal makes it easy to review elections and make revisions, as well as maintenance and benefit summaries year-round. Whether it’s a new hire or a new baby, HR and employees can make changes and maintain accurate records directly through BerniePortal.

The open enrollment experience is far easier to manage online than on paper. Employers are starting to pick up on this as well—online benefits administration is quickly becoming the industry standard.

Here are four questions to consider when shopping for a benefits administration platform:

1. Do employees make elections in the system?

For maximized efficiency, look for a system that allows employees to actually review and choose their benefits directly within the platform. The alternative would be a system that houses information manually uploaded by HR.

There are two key reasons to look for a genuine enrollment system. First, an enrollment system minimizes the possibility of human error, as opposed to a manual entry system. The second reason is that without it, employees are basically enrolling with paper—which is what employers are trying to escape in the first place.

2. Does it connect with the onboarding system?

After onboarding, most new hires want to make their benefits elections. It can be handy to have these two functions connected to ensure compliance, eligibility, and ease of use for the new employee.

3. Does it administer qualifying events?

Look for a system that can handle enrollment both during open enrollment and in the case of qualifying events, such as marriage, a new baby, loss of coverage, or other scenarios. Many benefits systems allow employees to self-service. In other words, they can update their own information in regards to qualifying events or benefits changes. If the system can only handle benefits elections during open enrollment, you will still have to maintain paper processes for other events.

4. Does it administer a full array of benefits?

Consider whether the system can handle a full array of benefits, including life, critical illness, dental coverage and more, as opposed to just the major medical plan. A benefits system reduces the administrative burden of offering several lines of coverage, so choosing a platform that can administer many types of coverages will allow employers to take advantage of those efficiency gains.

Because benefits touch so many parts of the HR ecosystem, in general, a comprehensive system that integrates benefits with other HR functionality will provide more value than a less robust system. Considering these five questions will help HR leaders find the right solution for their organization.

Here are a couple ways vendors should be supporting employers during open enrollment. If you aren’t getting this level of customer service, you may want to consider whether you have the right platform:

A quick turnaround

This applies to customer service issues in general—how quickly does your support team member get back to you? Are you constantly waiting for a response? Has it caused issues with your clients or employees?

But in particular, this also applies to build-outs. While implementing during open enrollment, how quickly is your vendor able to build-out groups? BerniePortal completes build-outs in one to three business days, compared to weeks or even months with other platforms.

Quality resources

Your vendor should provide a variety of resources that detail the platform’s features, uses and best practices, and more. BerniePortal provides daily demos, a searchable Knowledge Base, a Resource Library, and regular webinars with our leadership team and industry experts.

Here are a few examples to get you started:

Checklist: What to Do After Open Enrollment

While the end of open enrollment is certainly cause for celebration, there’s still more to do to ensure long-term success and happy teammates throughout the year. Consider the following steps that you should take after open enrollment season to guarantee success in the coming year:

Define what worked and what didn’t

While the experience is still fresh in your mind, take the time to document any areas of improvement you noticed this year. Did employees seem like they understood their options? Were they aware of deadlines? How were errors or questions handled?

Compile a list of these questions and plan to address each depending on their immediacy and importance. If it’s something that needs to be fixed right away, take the appropriate steps to do so. If it’s something that can be addressed at the start of the next open enrollment period, plan to implement changes in the lead-up to that process.

Educate employees

A common mistake that HR leaders often make is letting employee benefits communication fade once open enrollment is over. While it is important to ensure that employees understand their options when they’re trying to make elections, it’s equally important to maintain communication throughout the year.

For example, schedule regular reminders around how they can maximize the value of their benefits, and offer training sessions to improve familiarity and aptitude with your HRIS platform of choice.

Conclusion

There’s no denying it—open enrollment is tough, but that doesn’t mean it has to be even harder because of inefficiencies, errors and tight deadlines. It is possible to have a less stressful, more successful open enrollment period, and we hope this guide helps make that possibility a reality.

Ready to Streamline Open Enrollment?

See all the benefits and capabilities of BerniePortal’s all-in-one benefits administration & HR software.