Guide to HR Compliance

This guide will help you tackle the ever-changing legal landscape of HR to make sure that you are maintaining company compliance. We take you through the ins and outs of HR compliance best practices, including requirements for employee benefits and COBRA administration, guidance for employee leave, federal posting guidelines for HR notices, and employee privacy safeguards. We also touch on how a comprehensive software solution like BerniePortal can help your company remain compliant.

Company compliance is no easy task. Good HR professionals must stay on top of labor laws, regulations, general HR subject matter, as well as other considerations found in internal employee handbooks. Below, we’ll define compliance and look at the benefits of using software to handle your employee notices.

Company Compliance 101

What is HR Compliance?

HR compliance is defined as a company’s approach to regulations that meet and align with internal and external policies. This includes employment law compliance concerning employee notices, labor rules, and safety protections—all of which have specific and detailed requirements.

How Do You Maintain HR Compliance?

Administrators spend a significant amount of time maintaining company compliance. This includes managing, distributing, and documenting notices, defining practices that ensure employee safety, and implementing policies that adhere to local, state, and federal laws—all to remain compliant with state and federal laws.

This is easier said than done, especially for HR professionals at small- and mid-sized organizations. Yet HR compliance can be effectively and efficiently maintained using a human resources information system (HRIS) among other important human resources tools.

What Are HR Compliance Issues?

HR leaders at small and mid-sized businesses often struggle to stay current with changing regulations; organizations operating in multiple states face particular complexity.

HR Compliance Roles and Responsibilities

Maintain Compliance, No Matter What

Compliance isn’t optional. Certain components of company compliance—like employee notices—are tricky because they are strictly regulated and demand full compliance in order to avoid penalties. Authorities such as the Department of Labor (DOL) require employers to distribute specific notices throughout the duration of the employee’s employment and to document employee acknowledgment of each required notice.

Keep Up with Changing Compliance Regulations

As employment laws ebb and flow with the needs of the workforce, human resources officers must stay up to date on the latest legal changes and requirements in order to keep their organization fully compliant. Administrators must stay on top of which notices are required by law and adhere to the nuances that are specific to each notice.

Ensure Employee Participation in Compliance Efforts

Unfortunately, staying compliant isn’t always a predictable process because it depends on one key variable: employee participation. Since each of your employees has their own set of responsibilities, sometimes your priorities aren’t their priorities. As a result, administrators constantly find themselves expending significant effort to collect signatures from employees and to track employee participation in notices.

Documentation

Certain components of company compliance also require documentation. This ensures that the organization can respond to compliance-related inquiries from local, state, and federal authorities. For organizations that employ more than a handful of employees, maintaining all of these records can be a huge administrative burden.

Employee Benefits Legal Requirements

The Employee Retirement Income Security Act (ERISA) mandates that plan administrators must provide participants with the most important information about their retirement, health benefit plans, and materials about the operation and management of these plans.

Most employers are required to provide the following benefits notices to employees:

Health Insurance Plan and Benefits Coverage Options

When benefits enrollment is offered to employees—during open enrollment, when they join the team, or when they experience a qualifying life event—employers are required to provide a Summary of Benefits and Coverage (SBC) and Uniform Glossary.

According to the DOL, an SBC is a simple, easy-to-understand rundown of all benefits offered by the employer-sponsored plan. The Uniform Glossary is used to explain common terms that may be used throughout the SBC.

The plan administrator is also required to provide a summary of the plan, which is called the summary plan description (SPD). This is accompanied by a Patient Protection Notice.

Additionally, according to the Affordable Care Act (ACA), when employees are hired, employers must alert employees their time of hiring with the following information about their coverage options under the Fair Labor and Standards Act (FLSA):

- Informing Employees About the Existence of the Federal Healthcare Marketplace: This includes a description of services provided by the marketplace and how employees can learn more about the Exchange.

- Premium Tax Credit (PTC) Eligibility: If an employer’s plan’s share of total costs of benefits under the plan is less than 60% of the costs, employees may be eligible for a PTC.

- Potential Loss of Employer Contribution: If an employee purchases a health plan through the Exchange, they may lose access to the employer’s contribution (if applicable) for the employer-sponsored health plan.

In addition, all applicable large employers (ALE) are also required to deliver Form 1095-C to all full-time employees. Learn more about the Notice to Employees of Coverage Options.

COBRA Compliance

COBRA

Employers must inform employees about their rights to purchase COBRA continuation coverage in the event that they lose access to the health plan or the health plan ends.

The DOL provides employers with model notices that help employers clearly communicate these rights to employees.

Employee Leave

The Family and Medical Leave Act (FMLA)

The DOL states that employers that are covered under The Family and Medical Leave Act (FMLA) must provide notices to employees about their rights.

These notices include an employee’s eligibility for FMLA leave, their rights and responsibilities under FMLA, if their FMLA leave has been approved, and a general notice about the FMLA. Learn more about FMLA notices.

Medicare Part D Notice of Creditable Coverage

Before October 15 each year, employers must inform Medicare-eligible employees if prescription drug coverage provided by the group plan is creditable.

Learn more about the Notice of Creditable Coverage for Medicare.

Note that the above list doesn’t constitute a comprehensive list of all federal statutes and laws that require employer compliance. For more information, go to the DOL’s website.

Employee Privacy

HIPAA

According to the HIPAA Privacy Rule, when an employee enrolls in health insurance, employers must inform them about the privacy practices of their health plans and their personal health information.

Learn more about HIPAA and this important notice.

Additional Compliance Concerns

Other Required Benefits Notices

In addition to the previously mentioned notices, HR must also provide the following information to employees:

- Women’s Health and Cancer Rights Act (WHCRA) Notice

- Employer CHIP Notice

- Newborns’ Act Notice

- Summary Annual Report (SAR)

- Wellness Program Notices

- Grandfathered Plan Notice

HR Notices

Federal Posting Requirements

According to federal compliance regulations, employers must post specific posters in high-traffic locations that are clearly visible to employees and prospective employees. Companies staffed by a large remote workforce should also make these posters digitally available on the organization’s intranet in addition to the workspace posting.

At a minimum, these postings should include:

- EEOC-Equal Employment Opportunity

- Anti-Discrimination Notice

- Withholding Status

- Payday Notice

- USERRA – Uniformed Services Employment and Re-employment Rights Act

- FMLA – Family and Medical Leave Act

- Federal Minimum Wage

- Employee Polygraph Protection Act

- OSHA – The Occupational Safety and Health Act

Reporting & Distribution

Federal and state labor laws also require specific HR notices to be reported to the proper governing agency and distributed to employees. Please note that these notices do not account for specific industry and state variations.

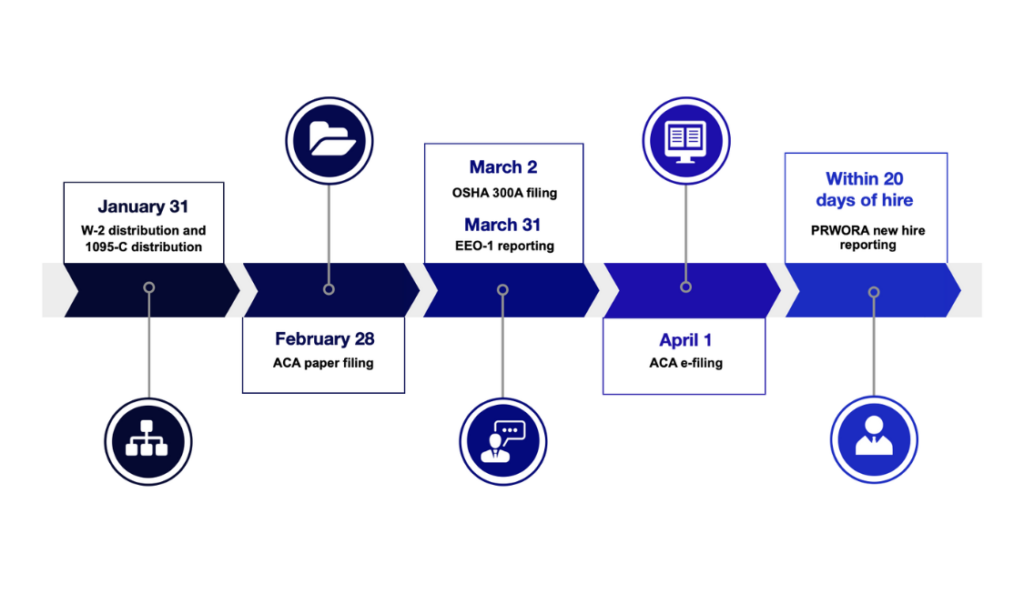

Federal Reporting & Distribution Timeline

Federal and state labor laws also require specific HR notices to be reported to the proper governing agency and distributed to employees.

What to Include in Your Culture Guide

A Culture Guide goes beyond the typical employee handbook by explaining the history of an organization, its mission, and vision. It discusses how the organization tackles problems and communication norms, as well as compliance need-to-knows.

Culture Guides also include norms for how colleagues treat each other, compensation philosophies, and information on employment law. In addition, they should discuss housekeeping items that help employees navigate daily life, such as how to connect to the printer.

HR Compliance Checklist 2023

Designate an Individual to Manage Notices

One of the best ways to keep your employee notices regimen compliant is to designate an official “notices handler” to be responsible for all things related to employee notices.

By choosing a single staff member to manage company notices, you gain administrative consistency, specialized expertise and reduce the likelihood of error due to miscommunication.

Document Your Procedure

Administrators should document the procedure that is taken to manage employee notices. By putting a procedure in writing, the administrator can establish an expected course of action that increases consistency within notices management.

This consistency is especially valuable with regards to the high turnover rate in the United States workforce. The clear and detailed documentation of internal procedures allows you to maintain your notice administration standard even as different people move in and out of the position.

Monitor Legal Changes

A constant battle for administrators is staying up-to-date on state and federal workforce regulations. Labor laws often evolve in response to changes in the workforce, which means that administrators must find a way to monitor these changes in order to stay compliant.

So what’s the best way to keep up with the latest labor laws? We suggest subscribing to the Department of Labor (DOL), the BerniePortal blog, and the Society for Human Resources Management (SHRM) for legislative updates. These subscriptions will alert you to changes in both local and federal laws that might impact your business.

Ensure Notices Are Accessible for Employees

Transparency is key when it comes to compliance. Your employees should be able to review notices from an easily accessed location. By maintaining this level of transparency, you allow others to hold you accountable, which means less risk of error and noncompliance penalties.

How to Handle Compliance Issues Using BerniePortal

Have you been looking for an easier way to keep employees updated with important changes within the company?

BerniePortal’s all-in-one HRIS includes compliance features that allow employers to keep employees updated and compliant with ease and efficiency—meaning HR has more time to spend time on tasks that matter most.

What Does BerniePortal Compliance Do?

Distribute notices:

Each organization is different. BerniePortal Compliance allows HR to distribute customized notices to specific groups of employees, which helps fulfill the needs of your organization while staying compliant with workforce regulations.

Collect signatures:

Using BerniePortal Compliance, administrators can collect employee signatures for each required notice. BerniePortal takes these signatures and documents them for future reference. Employees simply need to log into their portal to review and sign documents.

Consolidate data:

BerniePortal’s intuitive structure makes all notices easy to find and hard to lose—helping you maintain consistent and traceable records of all employee notices year-round.

Document compliance:

Without proof of compliance, your company may be subject to some hefty fines and penalties. BerniePortal Compliance documents all notices, acknowledgments, and downloadable PDF versions of each signed notice in order to help you prove your compliance.

Monitor participation:

Tired of spreadsheets? Our notices solution allows administrators to track the number of views and signatures collected for each distributed notice without any extra effort. Keep track of overall and individual participation with documentation of each employee agreement without leaving your computer.

Send reminders:

Not only does BerniePortal make note of the employees who haven’t completed their notices, but it also allows HR to send reminders to keep teammates on track with compliance needs. This functionality saves time because it allows employers to send reminders in bulk directly from their BerniePortal dashboard page.

Ready to Go Online With BerniePortal?

Simplify notice administration and compliance by adding BerniePortal Compliance to your toolbox.