Benefits Administration Software

In this guide, you’ll learn everything you need to know about digital benefits administration software and about employee benefits platforms in general. We will also cover the advantages of adopting a benefits admin software for your company, how to choose the best one, and finally, how to implement one within your organization.

A recent SHRM article reported that studies show “as many as half of workers intend to look for a new job” in 2021. For growing organizations, benefits packages play a significant role in both attracting talent and retaining employees.

At the same time, SHRM reported in summer 2020 that “more than two-thirds of information technology (IT) leaders said they expect to spend more on automation over the coming year.”

The takeaway? Small and mid-sized employers need to keep up by adopting HR technology and benefits administration software tools to streamline the process and remain competitive when recruiting top talent.

What is a Benefits Administration System?

Benefits Administration Systems Explained

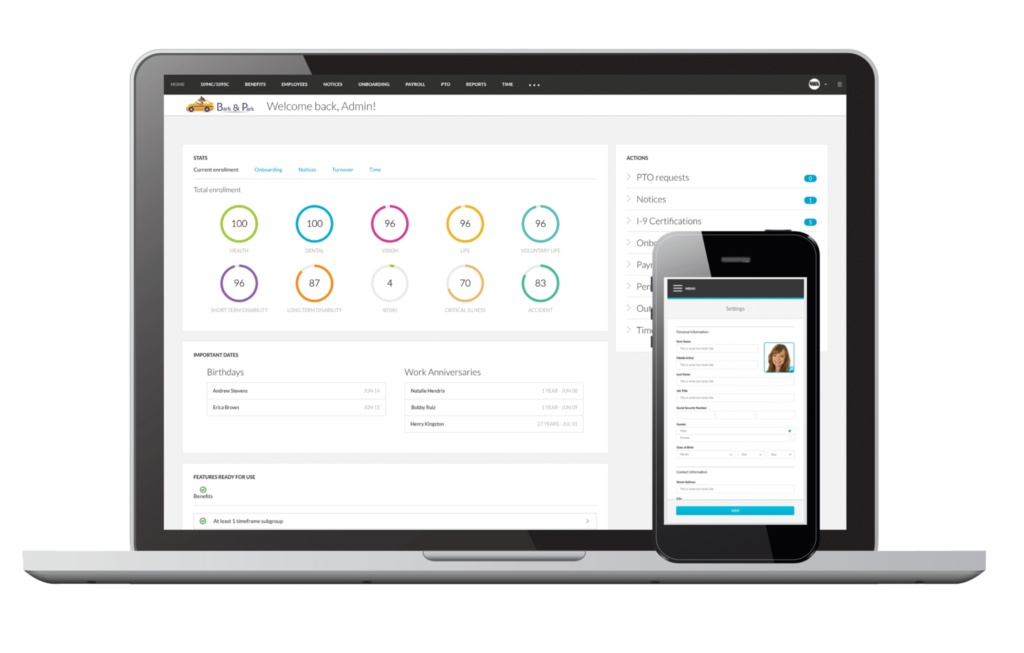

Benefits administration technology automates the traditional employee benefits selection and management process. Instead of filling out paperwork to select employer-sponsored benefits, employees can make selections using a digital employee self service system that automatically enrolls them in coverages once approved.

Typically, employees select benefits during open enrollment, when they join a company, or when they experience a qualifying life event.

What are the Major Types of Employee Benefits?

Common types of benefits offered by employers include:

- Healthcare coverage

- Life insurance

- Dental and vision insurance

- Short- and long-term disability insurance

- Identity theft protection

- Pet benefits

What are the Advantages of Benefits Administration Software?

If you haven’t taken your benefits administration online yet, consider some key reasons why you should use this kind of software:

Time Savings

Employers with paper benefits administration can spend up to an hour per enrollee completing tasks such as duplicate data entry, answering employee questions, and preparing benefit packets.

However, paper benefits administration isn’t just more time-consuming for HR—employees and brokers feel the burden as well. Benefit platforms speed up this process for everyone involved.

Reduce Errors

Online benefits administration automates data entry, which significantly decreases mistakes made when reading forms and completing other processes manually. In addition, the data collection process is integrated with insurance carriers, which also drastically reduces the opportunity for error.

Convenience & Satisfaction

Online benefits administration allows employers, employees, and other stakeholders to access benefits plan information at any time and from any place. This empowers employees to include others in the decision-making process, update their own benefits when qualifying life events occur, and even answer their own questions.

Analysis

At any given time, an employer can monitor and track the progress of their open enrollment from one teammate to the next.

By implementing a software solution for benefits administrative systems, HR will see significant advantages immediately and save time on the enrollment process. With this shift, HR teams can spend more time on key and high-value tasks competencies instead of hour after hour shuffling through administrative paperwork and answering repetitive questions.

8 Steps for Choosing the Right Employee Benefit Platform

There’s more to finding the right employee benefits software than simply selecting the option that best fits your team’s budget. Use the following eight steps to select the best employee benefits platform for your organization:

- Identify a Champion: This is someone at your company who spearheads research and the adoption of the technology.

- Pick Your Priorities: What is most important to your company? What in particular is driving this change?

- Identify Your Options: Compile a list of three to four vendors that seem to fulfill your criteria.

- Compare Products: Dig into the features, customer support, pricing, training, and scalability offered by each solution.

- Request Product Demos: Contact the vendors on your list and request demos of their products—and don’t forget to ask questions.

- Narrow the Field: Discuss with your team and narrow your choice down to one or two options. Write down all your questions and concerns for each solution.

- Make a Final Comparison: Compare options and select a final vendor from your short list.

- Begin the Contract Process: Once the paperwork is completed, you can now begin the training, implementation, and roll-out processes.

Ready to Go Online with BerniePortal?

See all the benefits and capabilities of BerniePortal’s all-in-one benefits administration & HR software.